Introduction to Fintech in India

How Fintech Is Changing India’s Personal Finances Imagine having a mobile phone that allows you to track your spending, invest your money, pay your bills, and take out loans. Fintech is now real in India it’s not just an idea anymore.

Fintech means using technology to manage money.

It is changing the way people in India handle their finances.

Before, using financial services like sending money or taking loans was slow and difficult.

But now, because of mobile apps and online platforms, these services have become fast, simple, and available to everyone even in villages and small towns.

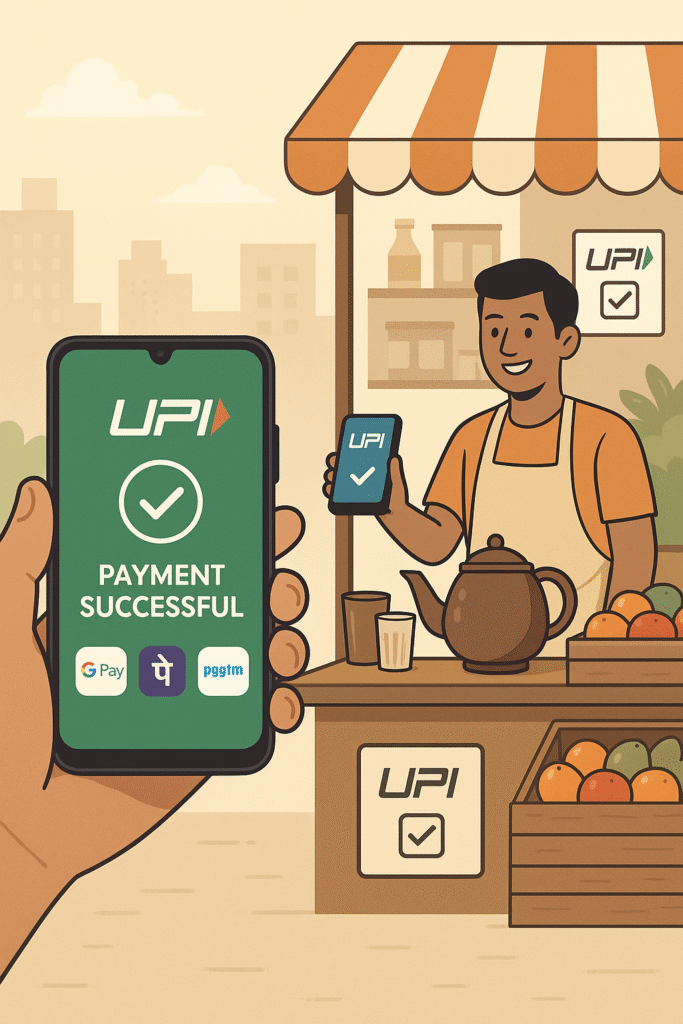

1.Easy Digital Payments (like UPI)

It used to take a while to send money to someone because of bank lines, NEFT delays, etc. However, people can now send and receive money in a matter of seconds thanks to UPI apps like Google Pay, PhonePe, and Paytm. UPI is now accepted by local businesses like grocery stores and chaiwalas. This speeds up, eliminates paper, and secures financial transactions.

2.Instant Personal Loans

Fintech businesses that offer loans online without requiring a lot of paperwork include Kissht, LazyPay, and PaySense. In the past, obtaining a bank loan required a lot of paperwork and time. Now, however, all you have to do is complete a form on your phone, and the funds are promptly credited. This is especially beneficial for people who are new to the banking system or don’t have a good credit history.

3. Smart investments for everyone

Apps like Groww, Zerodha, and Kuvera are helping regular people invest. These platforms make it easy for people who don’t know much about the stock market to invest in mutual funds and SIPs. People are now learning how to make their money grow instead of just putting it in fixed deposits or lockers.

4. Budgeting and Money Management

People can use fintech apps to keep track of their money coming in and going out. Walnut and ET Money are two apps that show you how much you spend on things like food, rent, and shopping. This helps people plan their money better and avoid spending too much.

Many of these apps also give tips on how to save money and achieve your financial goals.

5.Insurance and Tax Made Simple

Before, buying insurance or filing taxes was difficult and confusing.

Now, apps make it quick and easy to do these things from your phone. But now, fintech apps like PolicyBazaar and ClearTax make it easy for people to get health or life insurance in just a few minutes and file their taxes without having to hire a CA. This makes it easier for people with jobs and middle-class people to plan their finances.

6.Financial Inclusion in Rural India

Rural India has access to money Fintech is also making its way to tier-2 and tier-3 cities and even rural areas. People can now get loans, make payments, and open savings accounts with just a smartphone and the internet. This is helping a lot of people who don’t have bank accounts join the digital economy.

7.What will happen next in the world of fintech?

India is testing its own digital currency, the Digital Rupee (CBDC). AI-based personal finance: Apps will learn more about how you spend your money and make suggestions based on that. Voice-based payments: You can send money just by talking in your own language.

8.Final Thoughts

Remarks in India, fintech has completely changed personal finance. It has facilitated faster, simpler, and more inclusive banking and money management.You can now handle your finances with just a phone in your hand, regardless of your status as a homemaker, student, or small business owner. Every Indian now has access to financial power thanks to fintech.

Reference:

- TheStudyIAS – Growth Of India’s Fintech Ecosystem: Opportunities, Challenges, And The Path Ahead

- MoneyControl – Fintech Files part-1 : What they are and What they do.

FAQ: Fintech in India and Personal Finance

1. What is digital finance and how does it differ from traditional banking?

Digital finance refers to using technology to deliver financial services through mobile apps, online platforms, or digital tools. Unlike traditional banking, it offers real-time transactions, minimal paperwork, and wider accessibility. For example, transferring money or applying for a loan now takes minutes instead of days.

2. How do UPI payments work and why are they so popular in India?

UPI (Unified Payments Interface) allows users to send or receive money instantly using a mobile number or a virtual ID. Its simplicity, speed, and interoperability across banks have made it the most trusted digital transaction method in India.

3. Are mobile wallets still relevant with the rise of UPI?

Yes, mobile wallets like Paytm, PhonePe, and Amazon Pay continue to offer value through cashback, bill payments, and offline merchant support. While UPI handles direct bank transfers, wallets are preferred for smaller, day-to-day expenses and offers.

4. What are some trustworthy apps for budgeting and expense tracking?

Apps like Walnut, Money Manager, and ET Money help individuals categorize spending, set budgets, and track goals. These tools offer visual dashboards, alerts, and auto-categorization to simplify financial planning.

5. Can digital platforms help people with no credit history get loans?

Yes. Many loan platforms assess alternative credit data like mobile payments, social media behavior, or transaction history to offer credit to new-to-credit users. This expands access for students, freelancers, or individuals without a formal credit score.

6. What security features should I look for in a digital finance app?

Ensure the app has two-factor authentication, biometric login, transaction PINs, and end-to-end encryption. Also, check app store reviews and whether the platform is regulated by RBI or other financial authorities.

7. How can students benefit from using digital finance tools?

Students can use these tools to budget allowance, invest small amounts, or build a savings habit. Apps often offer educational tips, gamified saving, and user-friendly interfaces tailored for young adults.

8. What is the role of QR codes in digital payments?

QR codes simplify transactions by allowing users to scan and pay instantly without entering bank details. Street vendors, small shops, and service providers widely use QR codes for faster, contactless payments.

9. Can digital platforms help with investment planning for beginners?

Absolutely. Platforms like Groww, Zerodha, and Kuvera offer low-cost, easy-to-use interfaces where even beginners can invest in mutual funds, SIPs, or stocks with minimal documentation and guidance.

10. What are the most common mistakes people make with digital financial tools?

Mistakes include saving weak passwords, clicking phishing links, granting too many permissions, or neglecting to monitor spending. Users should regularly review transactions and stay alert to scams.

11. How is financial literacy improving through mobile applications?

Apps now include in-built financial lessons, budget coaching, and goal-based tips. This self-education has empowered people to make informed money decisions without needing formal education.

12. Are there tools that help manage taxes online?

Yes. Platforms like ClearTax and TaxBuddy allow individuals to file income tax returns, calculate deductions, and store documents—all digitally. Many apps also send alerts for deadlines and offer CA consultations.

13. How do digital tools support small business owners?

Small businesses use apps to accept payments, manage expenses, invoice clients, and even access working capital. These tools reduce dependency on cash and enable seamless recordkeeping.

14. Can rural users benefit from mobile-based financial services?

Definitely. With low-cost smartphones and increasing internet penetration, villagers and people in tier-3 cities can now save money, borrow credit, and pay digitally—all from their phones.

15. What happens if a digital payment fails or is incorrect?

Most platforms offer quick dispute resolution through chatbots or customer care. Refunds for failed UPI transactions are typically processed within 3–5 working days. Users should always keep screenshots and transaction IDs.

16. Do digital financial platforms encourage better savings habits?

Yes. Apps use reminders, auto-saving features, visual progress trackers, and milestone notifications to help users build consistent saving routines without much effort.

17. How do virtual debit cards work?

Virtual debit cards are digital versions linked to your bank account. They function like physical cards but are accessed via an app and used mainly for online purchases. They’re safer because details can be reset instantly.

18. Can these tools help track shared expenses among friends or roommates?

Apps like Splitwise and SettleUp make it easy to divide bills, calculate dues, and avoid confusion in shared living or travel situations. They’re ideal for roommates or groups splitting costs frequently.

19. How do digital systems affect money management for women?

Digital access gives women more autonomy over their money. Many platforms now offer features tailored to homemakers, entrepreneurs, or working mothers, encouraging financial independence.

20. What does the future hold for digital financial tools in India?

The future includes voice-based transactions, AI-driven savings suggestions, and biometric verification. While “fintech” adoption continues, integration with everyday life will only deepen.

Penned by Anjum Mulani

Edited by Unnati Jain, Research Analyst

For any feedback mail us at [email protected]

Transform Your Brand's Engagement with India's Youth

Drive massive brand engagement with 10 million+ college students across 3,000+ premier institutions, both online and offline. EvePaper is India’s leading youth marketing consultancy, connecting brands with the next generation of consumers through innovative, engagement-driven campaigns. Know More.

Mail us at [email protected]